Gross Domestic Product measures the market value of services and goods produced in a given period. It is widely used as a reference for the health of the national and global economies. GDP is important because it provides information about the health of the economy. When GDP is strong, manufacturing activity and employment are likely to be increasing as companies produce more finished products, hire more workers, and people have more money to spend. This is the real economy.

On the other side, financial markets are the marketplaces for trading securities and bonds of companies that produce services and goods, financial derivatives, and government bonds.

Gold and Crude Oil are commodities whose prices are affected by fundamental economic changes. Gold is a liquid asset; with the panic of the pandemic, people started selling it for cash and covering some of the portfolio losses; therefore, prices dropped significantly by March 12th. However, the prices started rising again with the belief that currencies would lose value after the announced stimulus measures.

Crude oil has plummeted for a while and finally dropped to $ -40 intraday trading on 04/20. The oil price decline is the dropping demand for oil, the expectation for slowing production, and an increase in inventory levels due to lack of demand.

Unemployment

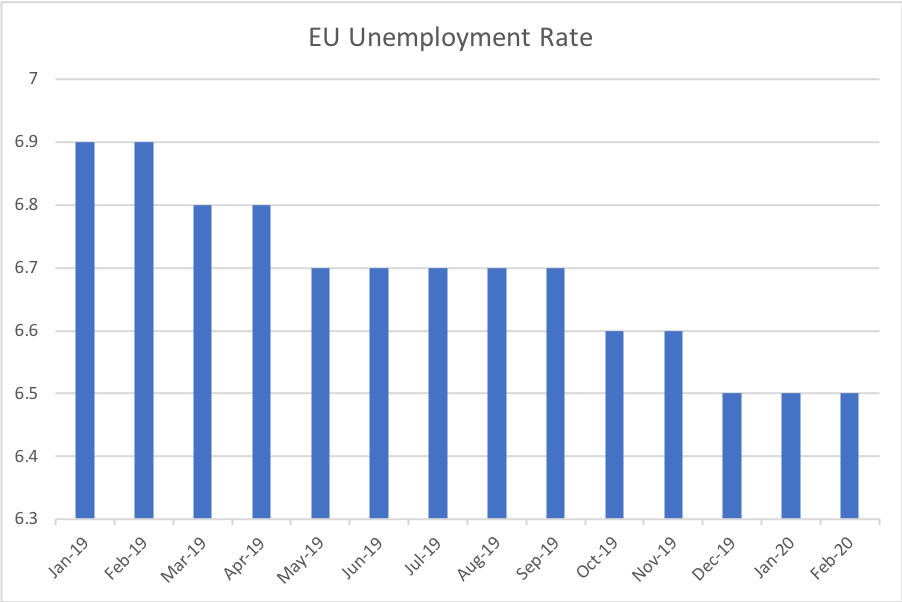

The labor market is one of the biggest hit by the pandemic as people worldwide lost their jobs permanently or partially. In the United States, unemployment claims increase every other week. The United States Congress approved a $2 trillion rescue package. Still, that measure has not helped the unemployment claim number to reach 26.4 million, an estimated 15 percent of the workforce in April compared to 4.4 percent in March. European Union had a 6.5 percent unemployment rate as of February 2020, but with the current pandemic, the International Labour Organization forecasts the loss of 12 million full-time jobs in Europe in 2020.

Compared to the United States, Europe has a different approach to unemployment. The United Kingdom covers 80 percent of the salaries of the unemployed with a £3000 cap, and many employers add to government contribution. The government pays a significant portion of the private sector salaries in Germany with the Kurzarbeit system. In France, the government covers 84 percent of the salaries of those on partial unemployment.

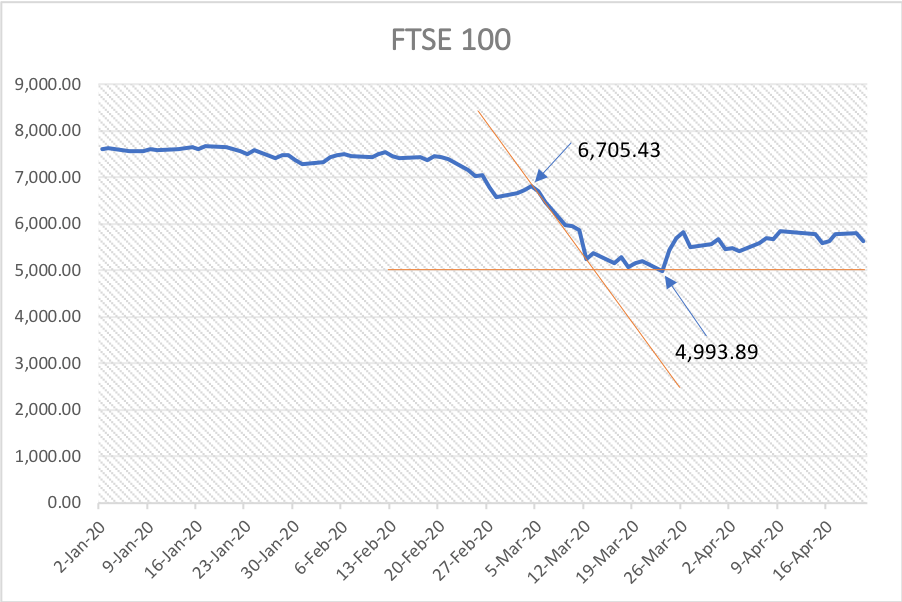

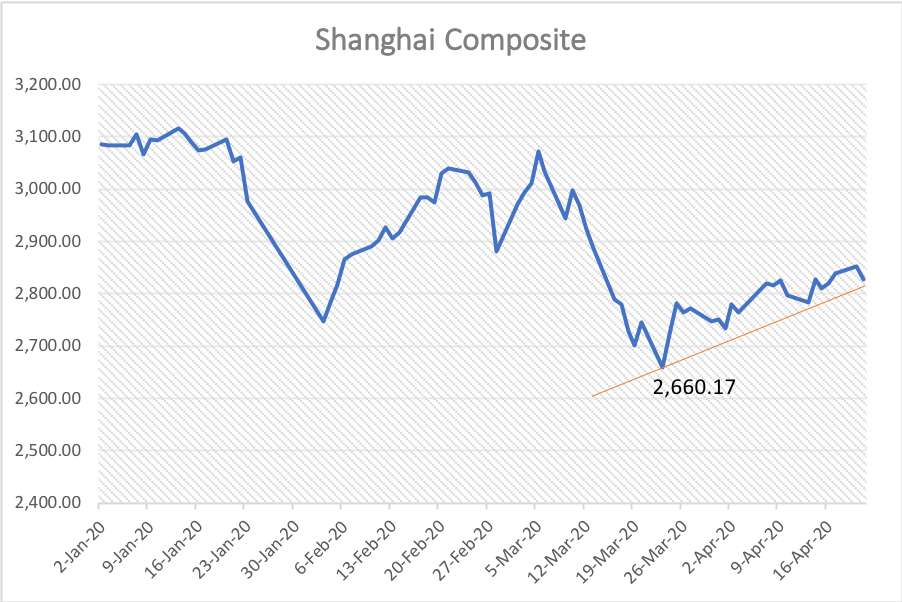

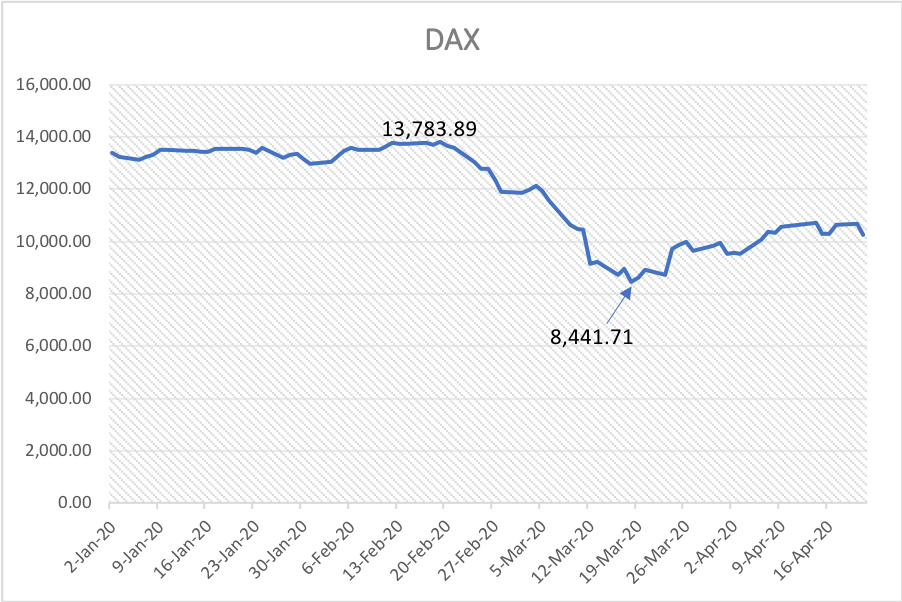

Major World Indices

Financial markets reacted to a pandemic with sell-offs that dragged prices down in different indices. Stock markets had corrections with fear of the bear market. Still, they started going up again with hopes that government stimulus packages would help the economy and that vaccination would be available soon to end the pandemic. Financial market recovery is somehow easier since transactions are faster than transactions in the real economy.

Recovery for the labor market and manufacturing can be slower than financial markets because it takes more time and effort. That being said, financial markets are important indicators, but not the most important, as employment numbers, manufacturing data, inventory levels, the housing market, real estate developments, and retail sales are the key indicators for the growth of an economy.

It is shocking (not surprising) to see Neoliberalist ask for the Keynesian approach of government involvement.

Disclaimer:

My writings and opinions are my own. They are not the views of my employer. I am not a financial advisor, investment adviser, and broker-dealer.

I have no access to non-public information about publicly traded companies. Information on this blog is based on my own opinion and experience and should not be considered professional financial advice.

Ideas and strategies used on this website should not be used without consulting a professional investment advisor / financial planner. Always do your own research before investing.

Sources:

https://www.imf.org/external/pubs/ft/fandd/basics/gdp.htm

https://www.ilo.org/global/lang–en/index.htm

Leave a comment