The banks facing difficulties in the USA and Switzerland include Silicon Valley Bank, Signature Bank, First Republic Bank, and Credit Suisse. Silicon Valley Bank, essential to the tech industry’s financial ecosystem, has been taken over by the FDIC following a classic bank run. Signature Bank has also faced a similar situation, while First Republic Bank is under severe pressure. Additionally, Credit Suisse has been acquired by UBS at the demand of Swiss authorities, resulting in widespread speculation about the possibility of additional unforeseen challenges.

What is a Bank run?

A bank run occurs when many depositors simultaneously withdraw their funds from a bank. Depositors lose confidence in the bank’s ability to fulfill its financial obligations, which results in them panicking and withdrawing their money.

The consequences of a bank run on the financial system and the overall economy can be severe. They can result in a domino effect, in which the failure of one bank triggers a loss of confidence in other banks, prompting more runs and further bank collapses. This, in turn, can lead to a contraction of credit and a decline in economic activity.

Many countries have established deposit insurance systems to prevent bank runs that protect depositors against losses if a bank fails. In addition, central banks may act as lenders of last resort, providing banks with access to liquidity during times of crisis.

The United States FDIC insures depositors up to $250k per account, and covering funds for uninsured depositors can mitigate the impact of bank runs.

The Diamond-Dybvig model (1983) analyzes the trade-off between liquidity and returns, a legitimate economic dilemma. People recognize that they may need immediate cash access for unforeseeable expenses, such as health emergencies, while productive capital is often not quickly sold on short notice. Prioritizing liquidity without financial intermediaries incurs costs because a significant portion of savings must be invested in low-yield liquid assets. (1)

However, financial intermediaries can solve this problem by issuing liquid liabilities like bank deposits or similar products that can be quickly converted to cash while primarily investing in high-return, illiquid assets. This approach works because aggregate cash demands are more predictable than individual cash requirements. A small liquid investment, like bank reserves or an equivalent, can meet daily needs.

Unfortunately, as Diamond and Dybvig noted, a system where financial intermediaries borrow money in liquid form but invest in illiquid assets is prone to multiple equilibria. If the public has confidence in the design, it will operate effectively. But if people expect others to withdraw funds in mass, they will do the same, causing problems for banks that need more time to liquidate their investments. (1)

So, why are tech venture capital firms suddenly needing their deposits? The answer is simple: high borrowing costs due to increased interest rates. Governments and banks work to save troubled banks to prevent any domino effect in the financial markets, but the moral hazard is inevitable. Unfortunately, financial institutions did not learn from their mistakes in 2008, and the Dodd-Frank Act regulation is only partially effective.

Top of Form

Bottom of Form

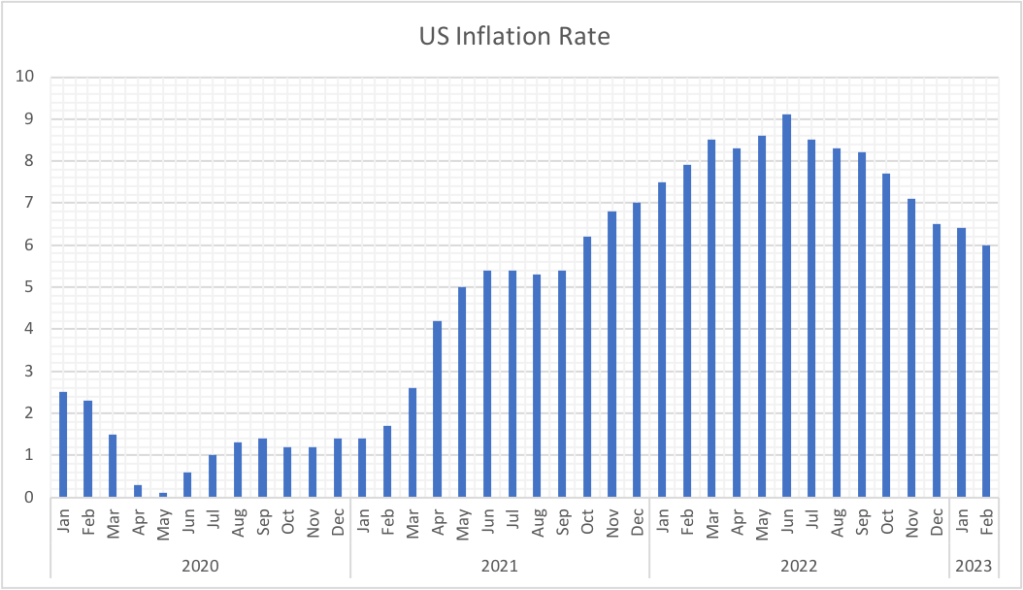

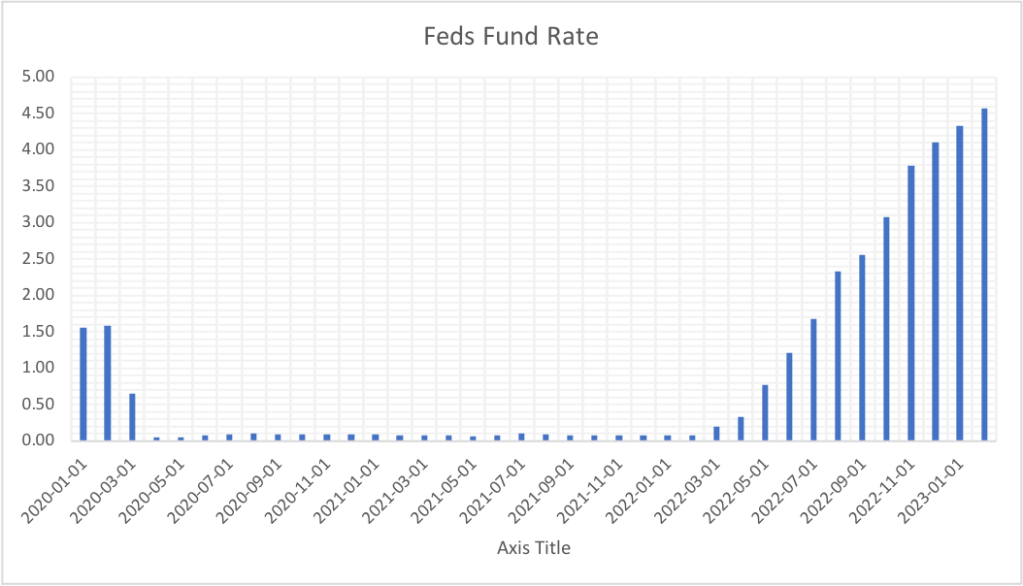

As mentioned above, bank runs are partially caused by expensive borrowing costs per sudden increase in the FED interest rates. Still, what did FED do against the increased inflation rates?

Above are the inflation and interest rates for 2020, 2021, 2022, and 2023.

| Inflation Rate | Interest Rate | ||

| 2020 | Jan | 2.5 | 1.55 |

| Feb | 2.3 | 1.58 | |

| Mar | 1.5 | 0.65 | |

| Apr | 0.3 | 0.05 | |

| May | 0.1 | 0.05 | |

| Jun | 0.6 | 0.08 | |

| Jul | 1 | 0.09 | |

| Aug | 1.3 | 0.10 | |

| Sep | 1.4 | 0.09 | |

| Oct | 1.2 | 0.09 | |

| Nov | 1.2 | 0.09 | |

| Dec | 1.4 | 0.09 | |

| 2021 | Jan | 1.4 | 0.09 |

| Feb | 1.7 | 0.08 | |

| Mar | 2.6 | 0.07 | |

| Apr | 4.2 | 0.07 | |

| May | 5 | 0.06 | |

| Jun | 5.4 | 0.08 | |

| Jul | 5.4 | 0.10 | |

| Aug | 5.3 | 0.09 | |

| Sep | 5.4 | 0.08 | |

| Oct | 6.2 | 0.08 | |

| Nov | 6.8 | 0.08 | |

| Dec | 7 | 0.08 | |

| 2022 | Jan | 7.5 | 0.08 |

| Feb | 7.9 | 0.08 | |

| Mar | 8.5 | 0.20 | |

| Apr | 8.3 | 0.33 | |

| May | 8.6 | 0.77 | |

| Jun | 9.1 | 1.21 | |

| Jul | 8.5 | 1.68 | |

| Aug | 8.3 | 2.33 | |

| Sep | 8.2 | 2.56 | |

| Oct | 7.7 | 3.08 | |

| Nov | 7.1 | 3.78 | |

| Dec | 6.5 | 4.10 | |

| 2023 | Jan | 6.4 | 4.33 |

| Feb | 6 | 4.57 |

As shown in the table above, I want to examine the relationship between inflation and interest rate. As we know, the main objective of the FED is to keep inflation in check at around 2%, but they kept the interest rates near 0 % as the inflation started increasing at the beginning of April 2020 to 4.2 until reaching the 8.5 % level in March 2022. They decided to interest rate increase after April 2022 and kept increasing the rates continuously until March 2023, and since then, the rate increase has continued non-stop. As FED plays an independent role, one may ask what they were thinking between April 2021 (inflation rate 4.2 %) and May 2022 (inflation rate 8.5 %) by keeping the rates near 0%. Once a zero, now a hero.

(1) – Bank Runs, Deposit Insurance, and Liquidity, Douglas W. Diamond University of Chicago, Philip H. Dybvig Yale University

Leave a comment